Purposes of foreign loans without Government’s guarantee

Foreign borrowing on a self-borrowing, self-repaying basis through loan agreements and disbursement in cash has become an increasingly common method of capital mobilization for enterprises. However, as such borrowings may impact on national economic and financial stability, borrowers must meet specific conditions to obtain foreign loans without a government’s guarantee. These conditions include requirements on loan agreements, borrowing currency, loan purposes, borrowing limits, and safety ratio compliance, as stipulated in Circular No. 08/2023/TT-NHNN and Circular No. 19/2024/TT-NHNN.

Conditions regarding the purpose of foreign borrowing are stipulated in Articles 14 and 17 of Circular No. 08/2023/TT-NHNN and are mandatory. Borrowers and lenders must agree on the purpose of the foreign loan and clearly specify it in foreign loan agreements.

1. The necessity of compliance with conditions on loan purposes

Requiring borrowers to comply with conditions on the purpose of foreign loans is essential for the following reasons:

First, from the lender’s perspective, clear and specific regulations on the purpose of foreign loans under the laws of the borrower’s country provide assurance that the loan will be used for intended purposes. This ensures consistency with the borrower’s commitments regarding the use of loan as stated in the foreign loan agreement.

Second, from the borrower’s perspective, legal regulations on the purpose of foreign loans help companies enhance their awareness in planning and utilizing borrowed funds in compliance with the law. This, in turn, contributes to ensuring that approved business activities achieve their intended effectiveness.

Third, from the perspective of state management, stipulating the purpose of foreign loans by enterprises without government’s guarantees enables the state to monitor how borrowed funds are utilized, assess their contributions to business development, and evaluate their impact on the national economy. This, in turn, allows for the formulation of appropriate policies to either restrict or encourage foreign loans in accordance with the prevailing economic and social context. Additionally, regulations on the purpose of foreign loans assist regulatory authorities in preventing the inflow of foreign funds into Vietnam for illegal activities such as money laundering and terrorism financing.

2. Loan purposes

Depending on whether the borrower is a credit institution, a foreign bank branch, or an enterprise, cooperative, or union of cooperatives, the regulations on foreign loans impose distinct conditions on the loan purpose. These conditions vary when enterprises seek to borrow from foreign sources without a government’s guarantee through loan agreements and disbursements in cash.

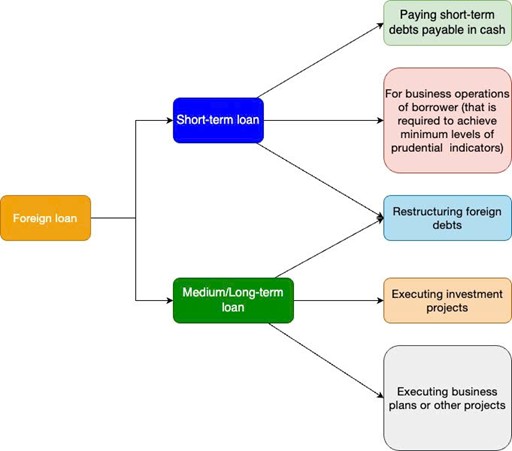

2.1. For borrower other than credit institutions and foreign bank branches

In the case of short-term foreign loans: the borrower may use the borrowed funds to repay maturing foreign loans[1], commonly referred to as restructuring foreign debt. Accordingly, if the borrower has an outstanding foreign debt nearing its maturity and lacks the ability to repay, it may obtain a new short-term foreign loan to settle the previous debt. Under Circular No. 12/2014/TT-NHNN, borrowers utilizing foreign loans for debt restructuring were required not to increase borrowing costs[2], However, in practice, borrowers often face difficulties in comparing the cost of new loans with previous ones. To alleviate these challenges in assessing and determining foreign borrowing costs for debt restructuring purposes, Circular No. 08/2023/TT-NHNN has removed the restriction prohibiting an increase in borrowing costs for new foreign loans.

In addition to the purpose of restructuring foreign debt, enterprises that are not credit institutions or foreign bank branches may obtain short-term foreign loans to settle short-term monetary liabilities arising from the implementation of business operations[3]. These short-term monetary liabilities do not include the principal of loans borrowed by enterprises from credit institutions, domestic enterprises, or individuals and are determined based on the accounting regime guidelines[4]. This means that borrowers may only obtain short-term foreign loans to settle liabilities already recorded in their accounting books and are not permitted to use such loans for short-term purposes that may arise in the future, as was previously allowed under Circular 12/2014/TT-NHNN. However, an exception applies to enterprises subject to financial safety ratio requirements[5], such as securities companies, fund management companies, branches of securities companies, and branches of foreign fund management companies operating in Vietnam, which may use short-term loans for business activities with a capital utilization period of up to twelve months.

For medium- and long-term foreign loans: borrowers may utilize the borrowed funds to implement investment projects, business and production plans, or other projects of the borrower. Additionally, such funds may also be used to repay previously obtained foreign loans[6]. Thus, it can be observed that, unlike short-term foreign loans, medium- and long-term foreign loans may be used to cover business activities arising during the implementation of investment projects, business and production plans, or other future projects.

In order to obtain approval for foreign loans, borrowers must demonstrate compliance with the conditions on the purpose of foreign loan utilization through the following documents:

- Investment Registration Certificate or Written approval for investment guidelines. This document is used to substantiate the purpose of foreign loan when the loan is intended for project implementation. An investment project comprises a set of proposals for utilizing medium- or long-term capital within a specific location and timeframe[7]. The content of the investment project is reflected in the Investment Registration Certificate or the Written approval for investment guidelines. This document is one of the common operational licenses for foreign-invested enterprises or businesses engaged in specialized activities, such as those requiring land allocation, land lease, nuclear power plant construction projects, or projects necessitating population relocation for resettlement, in accordance with investment laws.

- The plan for the use of foreign loan capital. This document is prepared by the borrower and approved in accordance with the authority stipulated in the charter and the laws governing the organization and operations of the borrower. It outlines the business and production plan utilizing the foreign loan proceeds. For enterprises that do not possess an Investment Registration Certificate or a Written approval for investment guidelines, the plan for the use of foreign loan capital serves as the primary document to substantiate the purpose of the foreign loan.

- The debt restructuring plan. The foreign debt restructuring plan serves as the supporting document to substantiate the purpose of loan for the restructuring of foreign debt. This document details information regarding the new foreign loan, the existing foreign debt to be repaid, and is approved by the competent authority of the borrower in accordance with its charter and the laws governing its organizational structure and operations.

Explore a related article: Foreign borrowing costs of enterprises without Government guarantee

2.2. For borrowers that are credit institutions and foreign bank branches

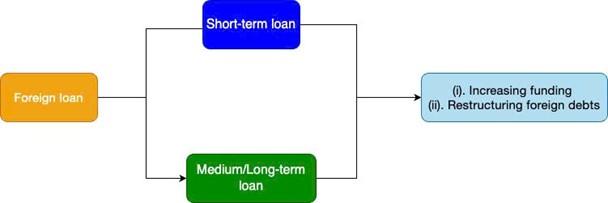

Credit institutions or foreign bank branches may obtain short-term, medium-term, or long-term foreign loans to supplement their capital sources, enabling them to continue credit granting activities in line with credit growth or to restructure foreign debt[8]. Thus, unlike enterprises, cooperatives, and unions of cooperatives, the purpose of utilizing foreign loan proceeds by credit institutions and foreign bank branches remains the same, regardless of whether the loan is short-term or long-term.

In order to obtain a foreign loan, borrowers in this category must substantiate the purpose of utilizing the loan proceeds through a plan for the use of foreign loan capital in the case of borrowing to supplement operational capital or through a debt restructuring plan in the case of borrowing to repay existing foreign loans.

3. Practical Implementation and Recommendations

As presented in Section 2 above, it is evident that the current legal framework establishes distinct requirements regarding the purpose of foreign loans for credit institutions and foreign bank branches as compared to other enterprises. The conditions concerning the purpose of foreign borrowing applicable to credit institutions and foreign bank branches appear to be less stringent than those imposed on enterprises. The rationale behind this differentiation lies in the nature of credit institutions and foreign bank branches, whose operations are directly linked to monetary activities and the national economy and are subject to stringent oversight by Vietnamese regulatory authorities. Additionally, these institutions are required to continuously comply with operational conditions such as charter capital requirements, prudential ratios, and governance structures. As a result, when engaging in foreign borrowing without government guarantees, they pose a lower risk concerning the receipt and utilization of borrowed funds.

Conversely, enterprises, cooperatives, and unions of cooperatives, which operate under the Enterprise Law, enjoy greater flexibility in selecting business activities and mobilizing capital from various sources. Accordingly, stricter requirements on the purpose of foreign borrowing enable regulatory authorities to effectively oversee the borrowing and utilization of funds, thereby mitigating potential adverse impacts on the economy and society. However, the practical implementation of these conditions has encountered certain challenges, necessitating adjustments as outlined below:

3.1. Short-term foreign loan:

- The borrower may use short-term foreign loans for the purpose of restructuring previously borrowed foreign debts and settling monetary liabilities recorded in its accounting books. However, the current regulations do not clearly specify whether short-term borrowing can be used to repay only short-term debts or also long-term debts that have reached their maturity. Therefore, it is necessary to clarify this provision by allowing short-term loans to be used for restructuring both long-term and short-term debts. Since Circular 08/2023/TT-NHNN has already provided detailed guidance on the required contents of a foreign debt restructuring plan, the monitoring of repayment status and cash flow is feasible. Moreover, permitting short-term borrowing for repaying long-term debts will encourage enterprises to strive for effective business operations to generate sufficient cash flow to meet the repayment obligations of the new short-term loan within a short period.

- Additionally, the current regulation, which restricts the use of short-term foreign loans to repaying already-incurred debts, may pose challenges and limit flexibility for many enterprises in their business operations. For instance, if a company temporarily lacks the cash flow to pay employees on their scheduled payday, it would have to first record the unpaid wages as a liability before securing a short-term foreign loan to settle the debt. This process could negatively impact employees’ rights and the company’s reputation. Therefore, it is advisable to allow short-term foreign loans to be used for short-term financial needs arising in the course of business operations.

3.2. Medium and long-term foreign loans:

- Similarly, medium and long-term foreign loans may also be used for restructuring the borrower’s existing foreign debts. However, the current regulations do not clearly specify whether such debts originate from short-term or medium and long-term loans. Therefore, it is necessary to provide clearer provisions explicitly allowing medium and long-term foreign loans to be used for restructuring both short-term and long-term debts. This is particularly important because, before disbursement, borrowers must register their loans with the State Bank of Vietnam (SBV), enabling regulatory authorities to monitor the purpose and cash flow of such loans.

- Borrowers are also permitted to obtain medium and long-term foreign loans to implement other projects. However, Circular 08/2023/TT-NHNN only defines “other projects” as those that do not require an Investment Registration Certificate or a Written approval for investment guidelines. The foreign borrowing regulations should provide clearer guidance on what qualifies as “other projects” for borrowers. Specifically, it should clarify whether such projects include those registered by the borrower to establish a subsidiary, other business activities added to the borrower’s registered operations that do not require an Investment Registration Certificate, or cases where the borrower contributes capital, purchases shares, or acquires equity interests in other enterprises.

When applying regulations on foreign borrowing by enterprises without government’s guarantees in practice, certain provisions remain unclear and require amendments or supplements. These adjustments will help borrowers better understand, interpret, and apply the regulations, thereby mitigating risks of administrative violations in foreign borrowing. At the same time, clearer regulations will enhance the effectiveness of state management agencies in monitoring loan inflows and foreign debt repayments. The above proposals regarding the purpose of foreign borrowing aim to contribute to the improvement of Vietnam’s legal framework in this section.

[1] Point a Clause 1 Article 17 Circular 08/2023/TT-NHNN.

[2] Clause 2 Article 5 Circular 12/2014/TT-NHNN.

[3] Point a Clause 1 Article 17 Circular 08/2023/TT-NHNN.

[4] Clause 1 Article 17 Circular 08/2023/TT-NHNN.

[5] Point b Clause 1 Article 17 Circular 08/2023/TT-NHNN.

[6] Clause 2 Article 17 Circular 08/2023/TT-NHNN.

[7] Law on Investment 2020, Article 3 Clause 4.

[8] Article 14 Circular 08/2023/TT-NHNN.

Disclaimers:

This article is for general information purposes only and is not intended to provide any legal advice for any particular case. The legal provisions referenced in the content are in effect at the time of publication but may have expired at the time you read the content. We therefore advise that you always consult a professional consultant before applying any content.

For issues related to the content or intellectual property rights of the article, please email cs@apolatlegal.vn.

Apolat Legal is a law firm in Vietnam with experience and capacity to provide consulting services related to Finance and contact our team of lawyers in Vietnam via email info@apolatlegal.com.

Nguồn: https://ift.tt/zcuySvq

Map: https://goo.gl/maps/JbCF1FiWPuD2Jsnx6

Thông tin: https://www.google.com.vn/search?q=Apolat+Legal&kponly=&kgmid=/g/11jkvqgmw_

Comments

Post a Comment